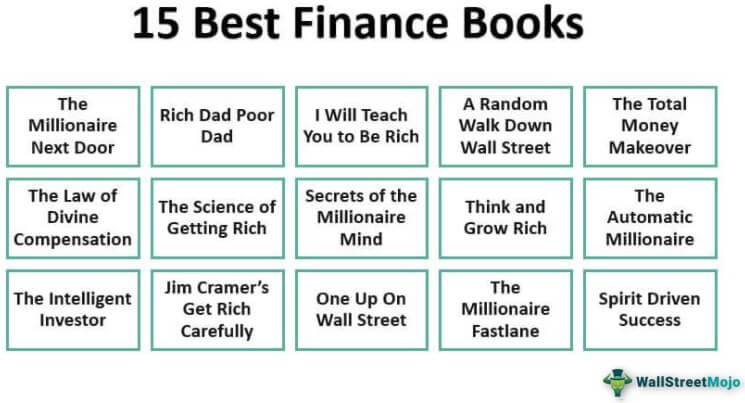

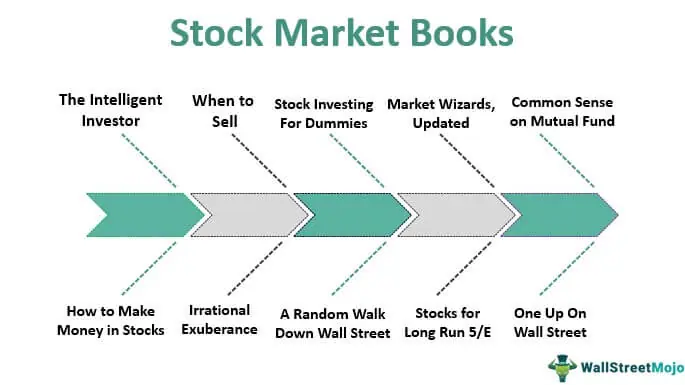

The Best Books for Understanding Money and Finance

Rich Dad Poor Dad by Robert Kiyosaki

As someone interested in personal finance and building wealth, you may be wondering which books can provide you with valuable insights. One book that stands out is “Rich Dad Poor Dad” by Robert Kiyosaki. It offers essential lessons and concepts that can shape your understanding of personal finance and help you on your journey to financial freedom.

Key lessons and concepts from the book

-

The difference between assets and liabilities: Kiyosaki emphasizes the importance of acquiring assets, such as real estate or stocks, that generate income, rather than liabilities that drain your resources.

-

The power of financial education: The author stresses the need to continuously learn about money and investing, as financial literacy is crucial to making informed decisions and building wealth.

-

Creating passive income: The book highlights the significance of creating multiple streams of income that do not require your active involvement, enabling you to achieve financial independence.

How it can help you understand personal finance and building wealth

“Rich Dad Poor Dad” offers a fresh perspective on personal finance, challenging conventional beliefs and encouraging readers to think differently. It provides practical advice and strategies for improving your financial situation, including methods to increase your income, reduce expenses, and take advantage of investment opportunities. By embracing the lessons from this book, you can gain a better understanding of how to manage your money, make wise financial decisions, and ultimately build wealth for yourself and your future generations.

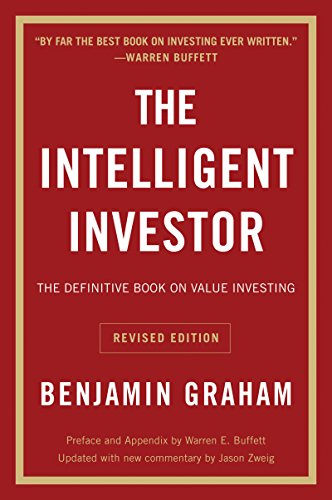

The Intelligent Investor by Benjamin Graham

The Intelligent Investor by Benjamin Graham is considered a must-read for those interested in finance and investment. It is widely regarded as a classic in the field and has had a significant impact on the way people approach investing.

Overview of the book's investment principles and strategies

Graham's book focuses on the concept of “value investing,” which involves purchasing undervalued stocks and holding them for the long term. He emphasizes the importance of conducting thorough research and analysis to identify stocks that are trading below their intrinsic value. Graham also stresses the need for investors to adopt a patient and disciplined approach to investing, rather than being swayed by short-term market fluctuations.

How it can enhance your investment knowledge and decision-making skills

Reading The Intelligent Investor can greatly enhance your knowledge and understanding of the principles of value investing. Graham's strategies, such as analyzing financial statements and assessing a company's competitive advantage, provide valuable tools for evaluating investment opportunities. Additionally, the book provides insights into the psychology of investing and the importance of maintaining a rational mindset in the face of market volatility.

By following Graham's timeless advice, readers can develop the skills necessary to make more informed investment decisions and achieve long-term financial success. Whether you are a novice or an experienced investor, The Intelligent Investor is a valuable resource that can help you navigate the complex world of finance with confidence.

Think and Grow Rich by Napoleon Hill

Think and Grow Rich by Napoleon Hill is a timeless classic that has transformed the lives of countless individuals in pursuit of financial success. This book delves into the mindset and success principles that can help anyone achieve their financial goals.

Exploring the mindset and success principles discussed in the book

Hill's book emphasizes the power of thoughts and beliefs in shaping one's financial destiny. He outlines key principles such as desire, faith, persistence, and specialized knowledge that can propel individuals towards wealth and success. This book encourages readers to cultivate a positive mindset and adopt focused thoughts to attract abundance into their lives.

How it can motivate and inspire you to achieve financial goals

One of the most compelling aspects of Think and Grow Rich is its ability to motivate and inspire readers to take action. Hill uses inspiring stories of successful individuals, including Andrew Carnegie and Thomas Edison, to demonstrate that anyone can achieve greatness if they have the right mindset and follow the principles outlined in the book. By emphasizing the importance of goal-setting, visualization, and perseverance, Hill provides readers with practical strategies to transform their financial aspirations into reality.

Whether you are just starting your financial journey or looking to break free from financial constraints, Think and Grow Rich offers valuable insights and strategies to help you achieve your financial goals. It serves as a powerful tool to help individuals unlock their potential and create a prosperous future.

A Random Walk Down Wall Street by Burton Malkiel

Understanding the efficient market hypothesis and its implications for investing

In “A Random Walk Down Wall Street” by Burton Malkiel, readers are introduced to the concept of the efficient market hypothesis (EMH). The book explains how the EMH states that stock prices reflect all available information, making it impossible for investors to consistently outperform the market by picking individual stocks. Malkiel provides evidence and arguments to support this theory, challenging the notion of stock picking as a successful investment strategy.

Key takeaways to help you make smarter investment choices

Beyond exploring the EMH, “A Random Walk Down Wall Street” offers valuable insights and strategies for investors. Some key takeaways from the book include:

-

Diversification: Malkiel emphasizes the importance of diversifying your investment portfolio to reduce risk. By spreading your investments across different asset classes, industries, and geographic regions, you increase the likelihood of achieving solid long-term returns.

-

Passive investing: The book advocates for passive investing through low-cost index funds, which aim to replicate the performance of a broad market index. This approach eliminates the need for constant monitoring and trading, while delivering competitive returns over the long run.

-

Behavioral finance: Malkiel explores the impact of human emotions and cognitive biases on investment decisions. Understanding these biases can help investors avoid making irrational choices driven by fear or greed.

“A Random Walk Down Wall Street” provides readers with a comprehensive overview of investment principles and strategies. Whether you are a seasoned investor or just starting out, this book offers valuable insights to help you make smarter investment choices.

The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Unveiling the secrets of wealthy individuals and their habits

In “The Millionaire Next Door,” authors Thomas J. Stanley and William D. Danko reveal the surprising secrets of the wealthy and their financial habits. They conducted extensive research and interviews to uncover the mindset and behaviors of individuals who have created substantial wealth.

The book challenges the common perception of millionaires, who are often associated with flashy lifestyles and extravagant spending. Instead, Stanley and Danko argue that the majority of millionaires are ordinary people who live frugally, save diligently, and make wise investment choices.

How it can provide insights on building and maintaining wealth

“The Millionaire Next Door” provides valuable insights and lessons on how individuals can build and maintain wealth. It emphasizes the importance of living below your means, saving a significant portion of your income, and avoiding excessive debt.

The book also highlights the significance of financial discipline and self-control, as well as the benefits of long-term planning and delayed gratification. By adopting these principles, readers can lay the foundation for financial success and gain a clearer understanding of the path to wealth.

Overall, “The Millionaire Next Door” is a must-read for anyone interested in personal finance and wealth-building. It challenges conventional notions about wealth and offers practical advice and strategies that can be implemented to achieve financial independence. Whether you are just starting your financial journey or looking to improve your current situation, this book is an invaluable

The Little Book of Common Sense Investing by John C. Bogle

In the world of finance and investing, it can be overwhelming to figure out which books are worth your time. But when it comes to understanding index fund investing, one book stands out – “The Little Book of Common Sense Investing” by John C. Bogle.

Introduction to index fund investing and its advantages

This book serves as a comprehensive guide to index fund investing, a strategy that involves buying and holding a diversified portfolio of securities that mirrors a specific market index, such as the S&P 500. Bogle explains the concept in a simple and easy-to-understand manner, making it accessible even for beginners.

One of the key advantages of index fund investing, as highlighted in the book, is its low-cost nature. By investing in funds that track the performance of an index, investors can avoid high fees and expenses associated with actively managed funds. Bogle also emphasizes the long-term benefits of index fund investing and the importance of staying the course during market volatility.

Why this book is essential for beginners and long-term investors

“The Little Book of Common Sense Investing” is invaluable for both beginners and long-term investors. For beginners, it provides a solid foundation in understanding the basics of investing and how to navigate the complexities of the financial markets.

For long-term investors, the book presents a compelling argument for the power of passive investing and the potential for superior long-term returns. Bogle's expertise and experience as the founder of Vanguard Group, one of the largest investment management companies in the world, lend credibility to his insights and advice.

Overall, this book is a must-read for anyone interested in investing and seeking a commonsense approach to building wealth over the long term. Its timeless lessons and practical guidance make it a valuable addition to any investor's library.

Thinking, Fast and Slow by Daniel Kahneman

For those seeking to enhance their financial decision-making skills, “Thinking, Fast and Slow” by Daniel Kahneman is an absolute must-read. This groundbreaking book explores the field of behavioral economics and its impact on our everyday choices.

Exploring behavioral economics and its impact on decision-making

Kahneman, a Nobel laureate in economics, delves into the two systems that drive the way we think: the fast, intuitive system (System 1) and the slow, deliberate system (System 2). He demonstrates how these systems influence our decision-making processes and outlines the cognitive biases that often lead us astray.

How understanding cognitive biases can improve your financial choices

By understanding these cognitive biases, readers gain valuable insights into their own thinking patterns and can make more informed financial choices. Kahneman provides practical strategies to overcome these biases, enabling readers to become more rational and deliberate decision-makers.

“Thinking, Fast and Slow” is a thought-provoking and enlightening read that challenges conventional wisdom and offers a fresh perspective on human decision-making. It is highly regarded in both the academic and business worlds for its profound impact on the field of behavioral economics.

Whether you are an investor, business owner, or simply interested in understanding the fascinating intricacies of the human mind, “Thinking, Fast and Slow” is a book that is sure to expand your knowledge and improve your financial decision-making skills.

The Richest Man in Babylon by George S. Clason

Lessons on personal finance and wealth accumulation through ancient parables

In “The Richest Man in Babylon,” George S. Clason delivers valuable financial advice through a collection of ancient parables. This timeless classic teaches readers how to achieve financial success and accumulate wealth by following simple yet powerful principles.

Through relatable stories set in the ancient city of Babylon, readers learn essential lessons on budgeting, saving, investing, and managing money. Clason's teachings emphasize the importance of taking control of one's finances and making smart decisions to achieve long-term financial goals.

Applying timeless financial principles to modern-day situations

One of the remarkable aspects of “The Richest Man in Babylon” is how its principles can be applied to modern financial situations. Despite being written many centuries ago, the book's lessons on discipline, frugality, and the power of compound interest are still highly relevant today. Readers can gain valuable insights into budgeting, debt management, building passive income streams, and creating a solid foundation for financial independence.

By following the practical advice presented in this book, individuals can develop good financial habits, improve their money mindset, and pave the way for a more secure financial future. “The Richest Man in Babylon” is a must-read for anyone looking to gain a deeper understanding of personal finance and set themselves on the path to wealth accumulation.

Conclusion

Reading finance books is a valuable investment for anyone looking to improve their financial knowledge and skills. Whether you are a beginner or an experienced individual, these books provide valuable insights, strategies, and advice to help you navigate the complex world of finance. By dedicating some time to reading these books, you can gain the knowledge and confidence necessary to make informed financial decisions and achieve your financial goals.

Summarizing the key benefits of reading finance books

-

Education and knowledge: Finance books provide you with a solid foundation of financial concepts and principles, helping you understand various financial instruments and strategies.

-

Wealth creation: By learning from the experiences and strategies of successful investors and entrepreneurs, you can gain insights into wealth creation and financial management.

-

Financial strategies: Finance books offer practical advice and strategies to effectively manage your money, invest wisely, and minimize financial risks.

Additional recommendations and resources for further learning

To continue your finance education journey, here are some additional recommendations and resources for further learning:

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Intelligent Investor” by Benjamin Graham

- “A Random Walk Down Wall Street” by Burton Malkiel

- Financial websites and blogs such as Investopedia, The Motley Fool, and Bloomberg.

Remember, reading finance books is just the first step. Applying the knowledge gained from these books and seeking professional advice when necessary will help you on your path to financial success.