Financial-Help Books Like Rich Dad Poor Dad

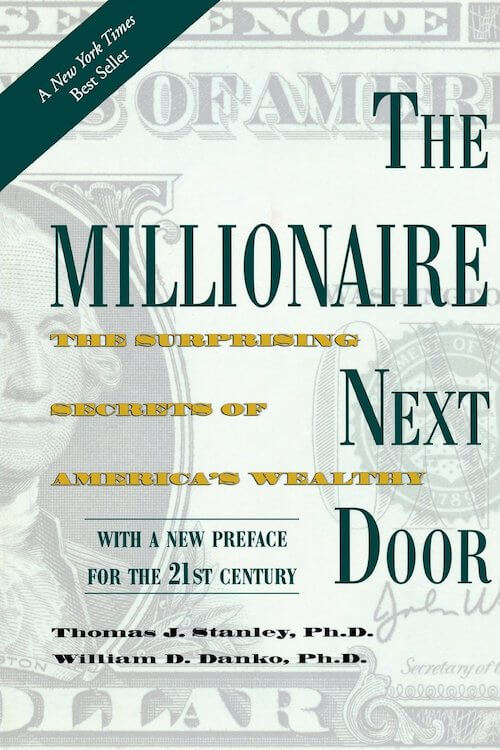

The Millionaire Next Door

Looking for more financial wisdom after reading Rich Dad Poor Dad? One book that comes highly recommended is “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko. This book takes a different approach to wealth and provides valuable insights for those seeking financial independence.

1. Key Concepts and Lessons

“The Millionaire Next Door” focuses on the idea that true wealth is often amassed by ordinary individuals who live below their means and prioritize financial independence. The authors conducted extensive research to understand the characteristics and habits of millionaires, debunking the stereotype that wealth is always associated with flashy lifestyles.

Some key concepts and lessons from the book include:

- The importance of frugality and efficient use of resources

- The value of hard work, discipline, and perseverance

- The benefits of living modestly and avoiding unnecessary expenses

- The significance of financial planning and investing for the long term

2. Advantages and Disadvantages

Advantages of reading “The Millionaire Next Door” include gaining a fresh perspective on wealth accumulation and learning practical strategies for financial success. The book offers actionable advice and real-life examples that can inspire readers to make positive changes in their financial habits.

On the downside, some readers may find the writing style dry or the concepts repetitive. However, the valuable insights and practical lessons make it a worthwhile read for anyone interested in building wealth and achieving financial independence.

Remember, the key to financial success lies in continuous learning and applying the knowledge gained from books like “The Millionaire Next Door” to your own financial journey.

Think and Grow Rich

1. Core Principles and Strategies

“Think and Grow Rich” by Napoleon Hill is a classic self-help book that offers valuable insights and strategies for achieving financial success. The book emphasizes the importance of mindset and the power of thought in creating wealth and achieving personal goals. It teaches readers how to develop a positive attitude, set clear goals, and overcome obstacles in their pursuit of financial independence.

One of the key principles discussed in the book is the concept of the “Master Mind,” which refers to the power of surrounding oneself with like-minded individuals who can provide support, guidance, and inspiration. Hill also highlights the significance of persistence and determination in overcoming challenges and setbacks along the way to wealth accumulation.

2. Real-life Success Stories

“Think and Grow Rich” is filled with inspiring success stories of individuals who have achieved great financial success by applying the principles and strategies outlined in the book. These stories serve as motivation and evidence that the principles discussed in the book can lead to tangible results.

The book covers a wide range of topics related to personal and financial growth, including overcoming fear, cultivating positive habits, and developing a burning desire for success. It offers practical advice and techniques that readers can implement in their own lives to improve their financial situations.

In conclusion, “Think and Grow Rich” is a must-read for anyone looking to improve their financial well-being. The book provides timeless wisdom and actionable strategies that have the potential to transform one's mindset and ultimately lead to financial success.

The Intelligent Investor

If you're looking for financial-help books that are similar to “Rich Dad Poor Dad,” then “The Intelligent Investor” by Benjamin Graham might be the perfect choice for you. This classic investment guide offers a wealth of knowledge and advice that can help you navigate the complex world of finance and make better investment decisions.

1. Value Investing and Financial Planning

One of the key concepts presented in “The Intelligent Investor” is value investing. Graham emphasizes the importance of buying stocks at a discounted price compared to their intrinsic value. By focusing on the long-term value of a company rather than short-term market fluctuations, Graham advocates for a disciplined approach to investing that prioritizes sound financial planning and risk management.

2. Tips for Successful Investing

“The Intelligent Investor” also provides readers with practical tips and strategies for successful investing. Graham discusses topics such as portfolio management, diversification, and the psychology of investing. He emphasizes the importance of conducting thorough research, maintaining a margin of safety, and avoiding emotional decision-making.

Overall, “The Intelligent Investor” is a valuable resource for anyone interested in learning about value investing and developing a solid financial plan. It offers timeless wisdom that can help investors make informed decisions and achieve their financial goals.

The 4-Hour Workweek

If you are on a quest to achieve financial freedom and design your ideal lifestyle, Timothy Ferriss's “The 4-Hour Workweek” is a must-read. This book offers valuable insights and strategies to help you escape the 9-to-5 grind and live life on your own terms.

1. Achieving Financial Freedom and Lifestyle Design

Ferriss shares his experiences and strategies for building a successful business that allows you to work less and enjoy life more. He challenges conventional wisdom and provides practical advice on how to streamline your life, focus on what truly matters, and create a sustainable income that supports your desired lifestyle.

2. Productivity Hacks and Outsourcing

One of the key themes of the book is maximizing productivity and leveraging outsourcing to free up your time. Ferriss introduces readers to concepts like “The Pareto Principle” (80/20 rule), which teaches you how to identify and focus on the 20% of tasks that yield 80% of the results. He also delves into strategies for outsourcing repetitive or less important tasks, allowing you to dedicate your time and energy to more meaningful endeavors.

Overall, “The 4-Hour Workweek” is a game-changer for those seeking financial independence and greater flexibility in their lives. By challenging traditional norms and offering practical solutions, Ferriss empowers readers to take control of their time, finances, and future.

Note: Always remember to research multiple sources, seek professional advice, and tailor your financial strategies to your individual needs and goals.

The Richest Man in Babylon

1. Wealth Accumulation and Financial Wisdom

If you enjoyed “Rich Dad Poor Dad,” you're likely to find “The Richest Man in Babylon” equally intriguing. This classic book by George S. Clason offers valuable lessons on how to accumulate wealth and make sound financial decisions. Through a series of parables set in ancient Babylon, the book shares timeless wisdom on saving, investing, and increasing one's wealth.

“The Richest Man in Babylon” provides practical advice on budgeting, saving money, and investing intelligently. It emphasizes the importance of paying yourself first, avoiding unnecessary debt, and building a strong financial foundation. The book offers simple, actionable strategies that readers can implement to improve their financial situation.

2. Storytelling and Historical References

One of the unique aspects of “The Richest Man in Babylon” is its use of storytelling and historical references. The author cleverly weaves together fictional characters and historical events to present financial concepts in an engaging and relatable way. This narrative approach makes the book both educational and enjoyable to read.

Through the tales of characters like Bansir, Arkad, and Dabasir, readers gain insights into the principles of wealth accumulation and financial success. The historical background provides a rich context for understanding the importance of financial literacy and the timeless nature of sound money management practices.

Overall, “The Richest Man in Babylon” is a must-read for anyone seeking to improve their financial knowledge and create a solid financial future. It offers practical advice, relatable stories, and historical references that make the book impactful and memorable.

The Automatic Millionaire

Looking for financial help books similar to “Rich Dad Poor Dad”? Look no further than “The Automatic Millionaire” by David Bach.

1. Building Wealth through Automation and Smart Habits

In this book, Bach emphasizes the importance of automating your finances to build wealth. He introduces the concept of the “pay yourself first” principle, where you set aside a portion of your income for savings and investments before paying any bills or expenses. Bach explains how automating this process can make saving effortless and help you grow your wealth over time.

Furthermore, Bach highlights the power of smart habits when it comes to financial success. He suggests implementing small but consistent actions, such as automatic contributions to retirement accounts or paying off debt, which can have a significant impact on your long-term financial well-being.

2. Practical Steps and Actionable Advice

“The Automatic Millionaire” provides practical steps and actionable advice that anyone can follow, regardless of their financial background. Bach breaks down complex financial concepts into easy-to-understand language and offers practical strategies for budgeting, saving, investing, and debt management.

Throughout the book, Bach shares real-life success stories of individuals who have implemented the principles outlined in “The Automatic Millionaire” and achieved financial freedom. These stories serve as inspiration and demonstrate that financial success is attainable for anyone willing to take action.

So, if you enjoyed “Rich Dad Poor Dad” and are looking for another insightful book that can help you on your path to financial success, “The Automatic Millionaire” is a must-read. It provides valuable knowledge, practical tips, and a roadmap to achieving financial security and building wealth.

The Barefoot Investor

1. Money Management and Financial Independence

Similar to “Rich Dad Poor Dad,” “The Barefoot Investor” focuses on providing readers with valuable insights into managing their money effectively and achieving financial independence. The book emphasizes the importance of creating a solid financial foundation, including managing debt, building an emergency fund, and setting up passive income streams.

The author, Scott Pape, offers practical advice that anyone can follow, regardless of their financial background or knowledge. He breaks down complex financial concepts into simple terms, making it easy for readers to understand and implement his strategies. Pape's approachable and relatable writing style makes this book a great resource for those looking to improve their financial situation and take control of their money.

2. Australian-based Strategies and Practical Tools

One aspect that sets “The Barefoot Investor” apart from other financial help books is its focus on Australian-based strategies and practical tools. Pape tailors his advice specifically to the Australian financial landscape, featuring information on tax-saving strategies, retirement funds, and the country's unique investment options.

The book also provides readers with practical tools such as budget templates and step-by-step guides to help them implement the strategies outlined in the book. Pape's hands-on approach ensures that readers not only understand the concepts but also have the necessary tools to implement them successfully.

Overall, “The Barefoot Investor” is an excellent choice for those seeking financial guidance, offering valuable insights, actionable advice, and practical tools specifically tailored to the Australian context. Whether you are just starting your financial journey or looking to improve your current situation, this book provides a roadmap to financial independence and security.

I Will Teach You to Be Rich

As someone interested in improving their financial situation, you may be looking for books that offer valuable insights and practical tips. One such book that is often mentioned alongside “Rich Dad Poor Dad” is “I Will Teach You to Be Rich” by Ramit Sethi.

1. Personal Finance Basics and Growth Mindset

“I Will Teach You to Be Rich” covers the fundamentals of personal finance in a relatable and straightforward manner. It teaches readers how to set up a solid foundation for financial success, including topics such as budgeting, saving, investing, and debt management. One key aspect emphasized in the book is the importance of developing a growth mindset when it comes to money. By adopting this mindset, readers are encouraged to see opportunities for wealth creation and take action to achieve their financial goals.

2. Millennial-friendly Tips and Strategies

With millennials in mind, Ramit Sethi tailors his advice and strategies to address the unique financial challenges faced by this generation. He offers practical tips on optimizing credit card rewards, automating finances, and negotiating salary increases. By presenting actionable steps in a relatable and engaging manner, Sethi demystifies personal finance for young adults and empowers them to take control of their financial future.

In summary, “I Will Teach You to Be Rich” is a valuable resource for anyone seeking to enhance their financial literacy and improve their money management skills. With its emphasis on personal finance basics and millennial-friendly strategies, this book is a helpful companion on the journey towards financial success.

Conclusion

If you are looking for financial-help books similar to Rich Dad Poor Dad, there are plenty of options available. These books can provide valuable insights and guidance to help you improve your financial situation and achieve success. Whether you are a beginner or already have some knowledge about personal finance, these books can offer fresh perspectives and practical advice.

1. Similarities and Differences between Rich Dad Poor Dad and Other Financial-Help Books

While Rich Dad Poor Dad is a popular choice for those interested in financial education, there are other books that share similar themes and lessons. Some authors, like Robert Kiyosaki himself, have written additional books that delve deeper into specific aspects of personal finance. Other authors offer their unique perspectives and strategies for building wealth and financial independence.

2. Choosing the Right Book for Your Financial Journey

When selecting a financial-help book, it's important to consider your specific goals and interests. If you resonate with the storytelling approach of Rich Dad Poor Dad, you may enjoy other books that use a similar narrative style. Alternatively, if you prefer a more technical or data-driven approach, there are books available that focus on specific investment strategies or financial concepts.

3. Recommended Next Steps for Financial Success

After reading a financial-help book, it's important to take action and implement the knowledge gained. This may involve creating a budget, setting financial goals, or exploring investment opportunities. Additionally, consider seeking advice from a financial professional to get personalized guidance based on your unique circumstances.

Remember, financial education is a lifelong journey, and reading financial-help books can be a valuable part of that journey. Continuously expanding your knowledge and implementing sound financial practices can lead to long-term financial success and security.